Binance Futures Explained Simply: Trading Crypto Price Bets (2025 Guide)

Heard About Binance Futures? Let's Break It Down Simply

So, you're exploring Binance and keep seeing "Futures." It sounds complex, maybe even a bit intimidating? Don't worry! While it involves risk, the basic idea behind Binance Futures trading can be understood quite easily.

Think of it like this: Futures trading is essentially a way to bet on the future price direction of a cryptocurrency. Will Bitcoin go up or down next week? With futures, you can place a trade based on your prediction, without actually having to buy or sell the Bitcoin right now.

This guide will explain the core concepts in plain English, helping you understand what you're getting into before you place your first futures trade on Binance.

What Exactly is a Crypto Future? The "Bet" Concept

Unlike buying Bitcoin directly (called "Spot trading") where you own the coin, a futures contract is technically an agreement to buy or sell a specific cryptocurrency at a predetermined price on a specific date in the future.

However, on platforms like Binance, most crypto futures (especially "Perpetual Futures") don't have a fixed expiry date. People trade them continuously, focusing purely on profiting from price movements.

In simple terms: You're making a structured bet on whether the price will go up or down from its current level.

Betting Up or Down: Going Long vs. Going Short

This is where futures get interesting. You can potentially profit regardless of which way the market moves, if your prediction is correct:

Going Long (Betting Up)

If you believe the price of a cryptocurrency (like Ethereum) will increase, you "go long" or "buy" a futures contract. If the price goes up as you predicted, your position becomes profitable.

Going Short (Betting Down)

If you believe the price of Ethereum will decrease, you "go short" or "sell" a futures contract. If the price falls as you predicted, your position becomes profitable.

Long = Rooting for the price to climb.

Short = Rooting for the price to drop.

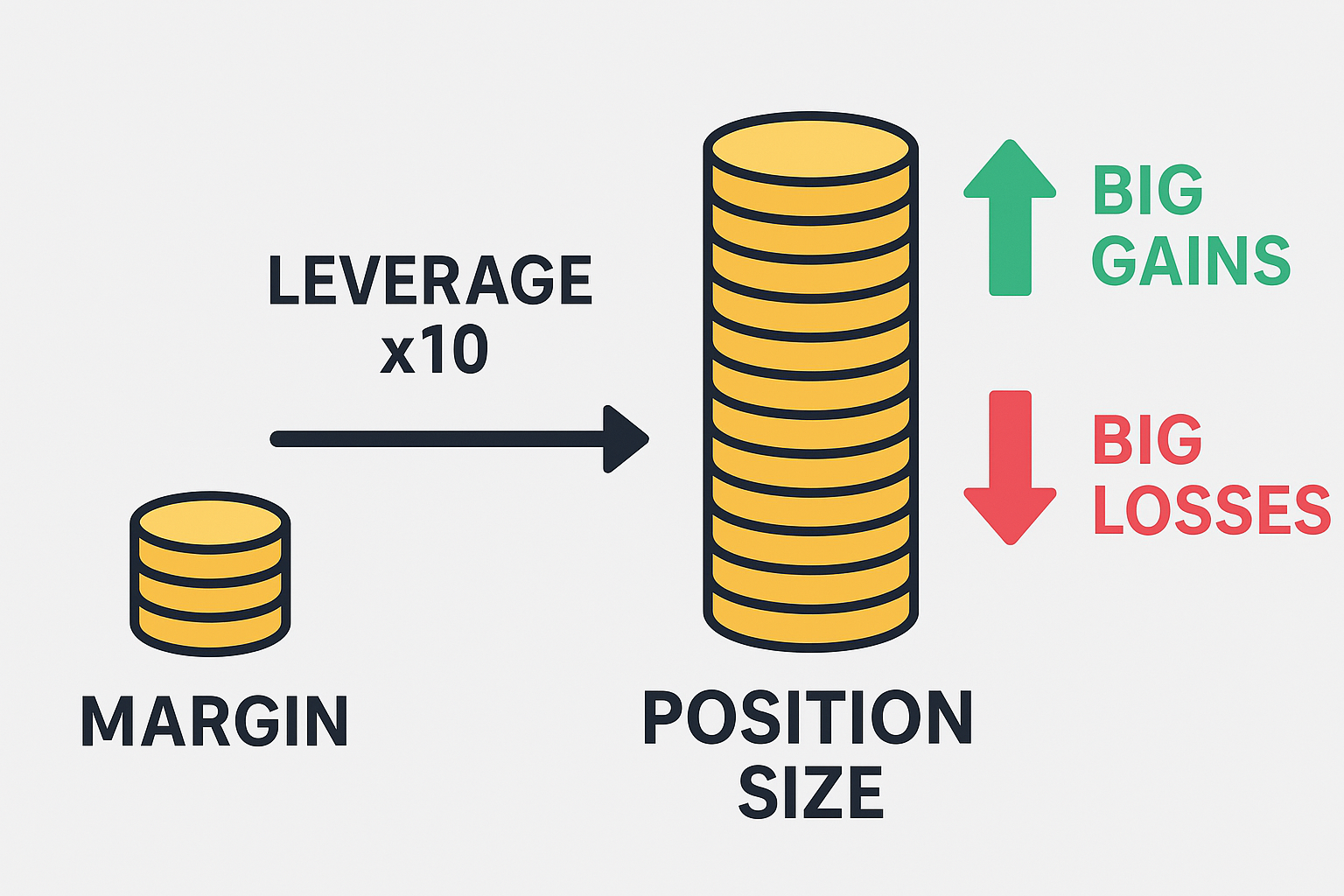

The Supercharger: Understanding Leverage

Leverage is a key feature of futures trading. It's like using a financial magnifying glass. Leverage allows you to control a large position size with a relatively small amount of your own capital (called "margin").

Example

Using 10x leverage means for every $10 you put up as margin, you can control a $100 position.

The Upside

If the price moves in your favor, your profits are magnified by the leverage factor (10x in this example). A small price move can lead to significant gains relative to your initial margin.

The HUGE Downside

Leverage is a double-edged sword. If the price moves against you, your losses are also magnified by the same factor. A small adverse price move can wipe out your initial margin very quickly.

Key Takeaway: Leverage amplifies both potential profits AND potential losses. It dramatically increases risk.

The Danger Zone: What is Liquidation?

This is the most critical risk beginners need to understand. Because you're using leverage (borrowed funds, essentially) to control a larger position, the exchange needs to protect itself.

Liquidation happens when the market moves against your position so much that your initial margin is nearly wiped out.

How it Works

- You deposit a small amount (initial margin) to open your leveraged position.

- The exchange sets a "maintenance margin" level – the minimum equity you must maintain.

- If losses drop your margin below this level, the exchange automatically and forcibly closes your position.

- You lose your initial margin. This is being "liquidated."

Why it Happens

With leverage, even a small percentage move against you can cause a 100% loss of your margin. The exchange closes your trade to prevent further losses.

Think of it: Your margin is the safety buffer. If the price moves too far against your bet, the buffer runs out, and the game is over for that trade – you're liquidated.

Understanding the Binance Futures Interface (Key Ideas)

When you open the Binance Futures screen, you'll see options like:

- Long/Short Buttons: To place your "up" or "down" bet.

- Leverage Slider/Input: Where you choose how much leverage to use (BE CAREFUL!). Start low!

- Order Types: Market (takes current price), Limit (sets your desired price).

- Margin: How much of your own money you're putting into the trade.

- PnL (Profit and Loss): Shows if your open trade is currently making or losing money.

- Liquidation Price (Est.): Binance usually shows an estimated price at which your position would be liquidated. PAY CLOSE ATTENTION TO THIS.

Crucial Risk Management: The Liquidation Price Calculator

Knowing your estimated liquidation price before you enter a trade is vital for risk management. It tells you how much room the price has to move against you before you lose your margin.

While Binance shows an estimate, understanding the factors helps:

- Entry Price: The price at which you opened the trade.

- Leverage: Higher leverage means the liquidation price is closer to your entry price (less room for error!).

- Margin: The amount of your own capital in the trade.

- Long or Short: The calculation differs slightly depending on your bet direction.

Estimate Your Liquidation Price

Note: This is a simplified estimation. Actual liquidation prices on Binance depend on specific maintenance margin rates, fees, and funding rates, which can vary. Use this as a guide for risk assessment, not as an exact guarantee.

Why this is useful: It helps you visualize the risk. If the estimated liquidation price looks dangerously close to the current price, you might reconsider the trade, use less leverage, or set a stop-loss order.

Estimating Potential Gains/Losses

Just as leverage magnifies losses, it also magnifies potential gains. Understanding how much you could potentially make (or lose) for a given price movement is also important.

Estimate Your Potential PnL

Note: This estimation does not include trading fees or funding rates, which will affect your actual PnL. Use for illustrative purposes.

Getting Started with Binance Futures Safely (Crucial Advice!)

Futures trading is inherently risky, especially for beginners. If you decide to try it:

EDUCATE YOURSELF

Understand these concepts thoroughly before trading real money.

START EXTREMELY SMALL

Use tiny amounts you are completely okay with losing.

USE VERY LOW LEVERAGE

Start with 2x or 3x leverage, maximum 5x, while learning. Avoid high leverage (20x, 50x, 100x+) until you are very experienced. High leverage leads to fast liquidations.

UNDERSTAND RISK MANAGEMENT

Learn about setting Stop-Loss orders to automatically close your trade at a predefined loss level before liquidation occurs.

NEVER INVEST MORE THAN YOU CAN AFFORD TO LOSE

This is paramount in futures trading.

Conclusion: Futures are Powerful Bets, Handle with Extreme Care

Binance Futures offer the exciting possibility of profiting from crypto price movements, whether up or down, using leverage to potentially amplify gains. However, that same leverage drastically amplifies losses and makes liquidation – the complete loss of your trading margin – a very real and common risk, especially for the unprepared.

Treat futures trading seriously, understand the mechanisms of longs, shorts, leverage, and liquidation, start small, and prioritize risk management above all else.

Ready to explore further? Remember the risks and start cautiously.

Last updated: April 3, 2025

- Heard About Binance Futures? Let's Break It Down

- What Exactly is a Crypto Future? The 'Bet' Concept

- Betting Up or Down: Going Long vs. Going Short

- The Supercharger: Understanding Leverage

- The Danger Zone: What is Liquidation?

- Understanding the Binance Futures Interface

- Crucial Risk Management: The Liquidation Price Calculator

- Estimating Potential Gains/Losses

- Getting Started Safely

- Conclusion: Handle Futures with Care

Trade futures cautiously on the world's leading exchange.

Trade on BinanceStart Trading Cryptocurrency Today

For users in supported regions, Binance offers industry-leading security, low fees, and a wide range of features.

Create a Binance Account